Renters Insurance in and around Kalamazoo

Looking for renters insurance in Kalamazoo?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- portage

- mattawan

- three rivers

- van buren county

- allegan county

- cass county

- saint joseph county

- constantine

- schoolcraft

- richland

- plainwell

- westwood

- Gull Lake

- oshtemo township

- texas corners

- galesburg

There’s No Place Like Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented property or townhouse, renters insurance can be one of those most reasonable things you can do to protect your stuff, including your laptop, exercise equipment, boots, coffee maker, and more.

Looking for renters insurance in Kalamazoo?

Renting a home? Insure what you own.

Protect Your Home Sweet Rental Home

Renting is the smart choice for lots of people in Kalamazoo. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance might cover smoke damage to the walls or an abrupt leak that causes water damage, that doesn't cover the things you own Finding the right coverage helps your Kalamazoo rental be a sweet place to be. State Farm has coverage options to align with your specific needs. Thankfully you won’t have to figure that out by yourself. With empathy and reliable customer service, Agent Kory Wagonmaker can walk you through every step to help you build a policy that secures the rental you call home and everything you’ve invested in.

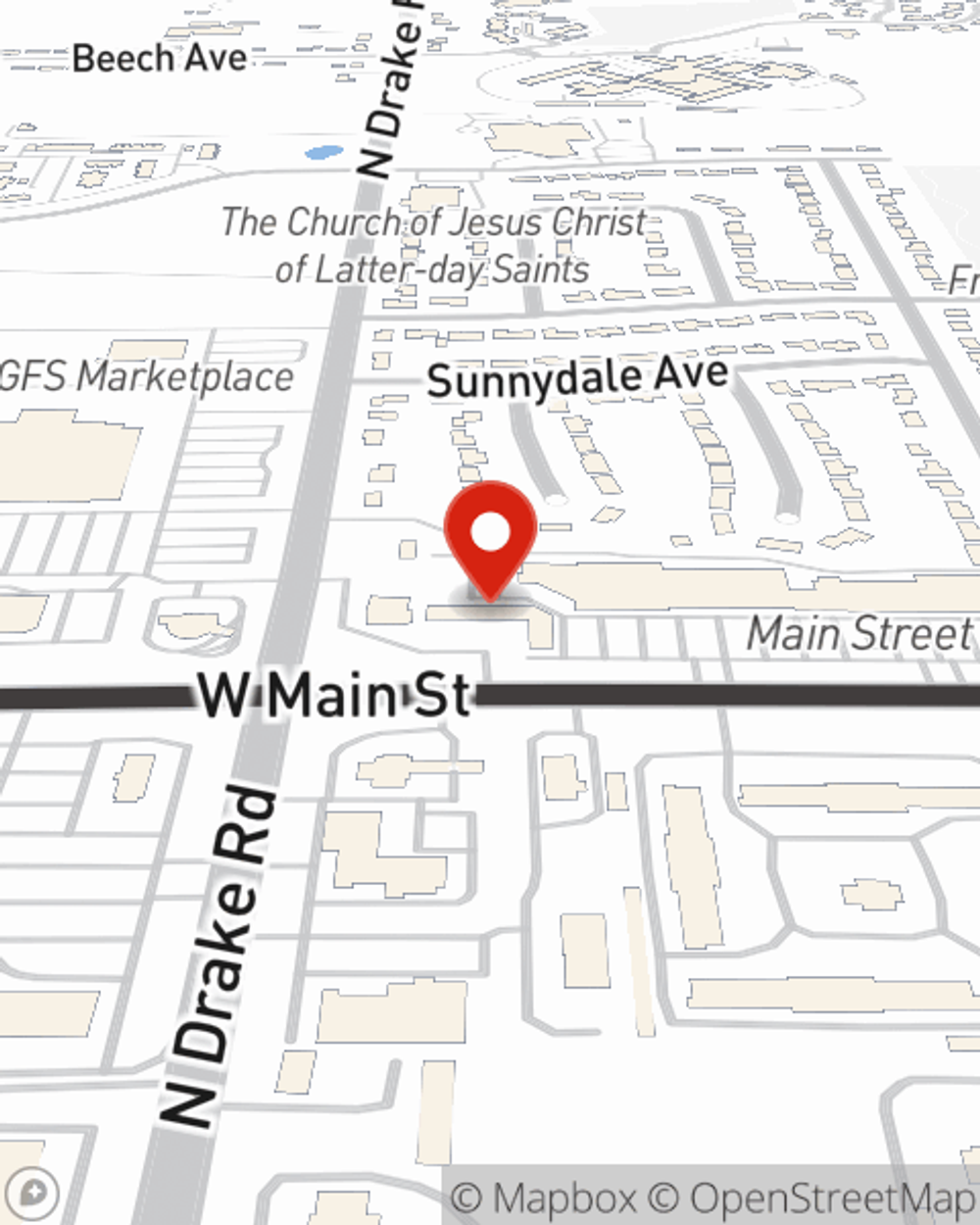

More renters choose State Farm® for their renters insurance over any other insurer. Kalamazoo renters, are you ready to discuss your coverage options? Get in touch with State Farm Agent Kory Wagonmaker today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Kory at (269) 488-4900 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Kory Wagonmaker

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.